Ratio indices deliver quick information about the essential financial characteristics of the company. They may be considered as a sort of a sieve that detects areas that need a more thorough analysis. They enable making intercompany comparisons or comparisons with the industrial average.

Ratio indices are based upon financial statements of the balance sheet and the profit and loss report. The basis of this analysis is formed by the ratio of two absolute indices. The company´s indebtedness, for instance, can be established as the share of the overall debt of the total funds in %, the sales profitability as profit share per CZK 1,- of the sales (usually in %), the inventory turnover as the number of stock-turns per annum (6 * for instance) or in days.

Ratio indices deliver quick information about the essential financial characteristics of the company. They may be considered as a sort of a sieve that detects areas that need a more thorough analysis. They enable making intercompany comaparisons or comparisons with the industrial average.

A financial analyst is supposed to take into consideration also the economic environment the company operates in, in particular what sort of market the company is doing business on, what its position is, whether it supplies to the local market or exports its production, etc.

In practice, 5 groups of ratio indices are used:

1. Indices of profitability, rate of return (profitability ratios)

They measure the profit through enterprise against the total volume of financial resources utilized for its realization. These indices measure the overall management effectiveness of the company and rank among the most important indices, such as:

*Return on investment (ROI) = pre-tax profit + interest expense / total investment*

*Return on assets (ROA) = net income / total assets*

*Return on equity (ROE) = net income / shareholder´s equity*

2. Indices of liquidity (liquidity ratios)

They define the company´s ability to meet their engagements. The ratios measure what can be paid against what has to be paid. They deal with the most liquid assets of the company and split into the following groups according to the degree of liquidity of assets introduced from the balance sheet. For instance:

*Current assets = short-term assets / current liabilities*

*Available assets = short-term assets – inventory / current liabilities*

*Liquid assets = cash + equivalents / liabilities fallen due*

3. Indices of activity (asset management)

They measure how effectively the company manages their assets. If they have more than is expedient, some extra costs are incurred, which subsequently leads to a low profit. If they lack assets, then they have to give up some business opportunities, and lose revenues. For example:

*Bound on total assets = assets / annual revenues*

*Inventory turnover = annual revenues / inventory*

*Receivables turnover time = trade receivables / daily sales invoiced*

4. Indices of indebtedness, structure of resources (debt management)

They define the relation between external and internal sources of the company funding, and measure the extent in which the company uses debt for funding. The larger is the share of the shareholders´ capital, the bigger is the safety cushion protecting the creditors from losses in case of liquidation. The owners, on the other hand, look for a financial leverage to multiply their income. The finacial leverage is a phenomenon when, under certain conditions, the return on equity can be positively effected by a higher share of the borrowed capital. For instance:

Legal aspects of insolvency and reorganization

The Real | Interim Manager for Your Changes

Manager work model

Time management - making use of time effectively

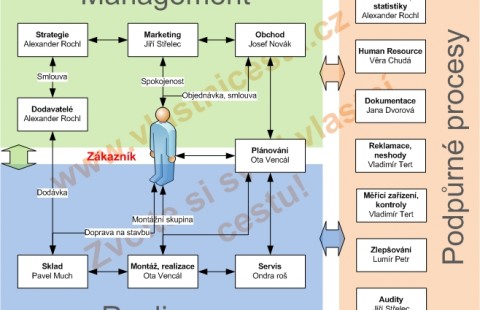

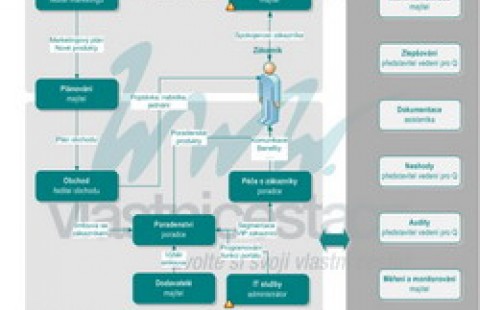

Jak správně tvořit mapu procesů

Modelling and setting the processes and procedures - ISO 9001

Training - preparation of the SWOT analysis and strategy

Company Management System of Quality Step by Step - ISO 9001

Process map acc ISO 9001 - business offer

*Overall indebtedness = borrowed capital / total assets*

*Interest coverage = pre-income tax and pre-interest payment profit / interest*

*Long-term coverage of fixed assets = equity + long-term capital / fixed assets*

5. Indices showing market value (market value ratios)

Investors who have invested their capital into the company´s registered capital, potential investors and all those who trade in the capital market take interest in the return rate of their investments. It is achievable either through dividends or through an increase in the share price. The share price is meant to be the price of an ordinary exchange-admitted or off-exchange share. For instance:

*Earnings per share = net profit / number of ordinary shares (EPS)*

*Earnings yield = earnings per share / market share price (E/P)*

*Dividend per share = net profit / number of ordinary shares (DPS)*

The financial analysis has been prepared for you by "**Jana Sovová**":sovovajana@seznam.cz

If you need to learn about the real financial standing of your company, have us elaborate "a financial analysis here.":http://www.ownway.eu/offers/sound-company-financial-analysis/